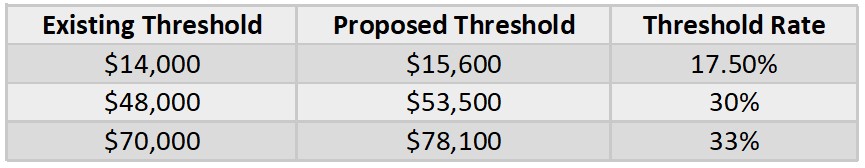

There is a much welcome increase in the individual income tax brackets. These thresholds have been untouched since the 2011 income year leading to huge lag behind inflation rates. This catch-all will ensure a direct benefit is received by all income earners. Although it should be noted these increases are well overdue and do not come close to matching the inflation rate since the original inception of these thresholds in 2011. Interestingly, National have not reduced to the top income tax bracket of 39% for individuals who earn income in excess of $180,000

The changes to residential rental properties rules are sure to shake up the property industry. Although fully expected, the Brightline period reduction to two years will be welcome news to property investors and speculators. Although interest deducibility will be restored, this will not take full effect until the April 2026 (the 2027 income year). It will be interesting to see how the market responds given house prices were expected to fall by 5% in a recent Treasury prediction…

The foreign buyer tax for high-value properties in conjunction with the existing foreign buyer ban shows National are targeting the wealthy to ignite the economy. Under these rules a $3m property sale would attract tax of $450k which would go straight into the government kitty

Perhaps surprisingly, there are no updates regarding the trustee tax rate of 39% which was recently introduced by Labour. This 39% rate looks set to take effect from 1 April 2024 irrespective of which party is in power post-election. This is a kick in the teeth for those who operate businesses via trust ownership as any income not distributed to beneficiaries will be taxed at the new 39% trustee rate. It is likely to result in serious considerations around restructuring in the coming months

There was talk around potentially scrapping tax exemptions for churches and charities. Although this has been ruled out for the time being, it has not been ruled out down the line. It is important to note that a lot can change in short period of time in politics. Therefore, should National be elected, further changes or tweaks to these policies may be made